EUR/USD drops further and challenges 1.1000 on Lagarde

- EUR/USD losses the grip further and retests 1.1000.

- ECB’s Lagarde said the economy would growth robustly in 2022.

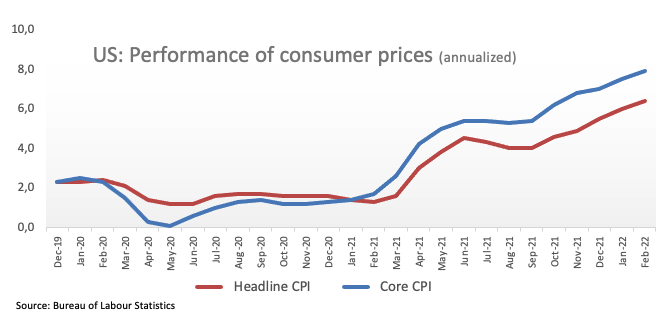

- US headline CPI rose 7.9% YoY, Core CPI gained 6.4%.

EUR/USD accelerates losses and revisits the 1.1000 neighbourhood following the moderate pick up in the demand for the greenback.

EUR/USD fades the spike to the 1.1120 region

Following the earlier advance to multi-day peaks in the 1.1120/25 band, EUR/USD came under some selling pressure and now revisits the key support at 1.1000 the figure.

Indeed, EUR/USD shed further ground after Chief Lagarde suggested inflation in the region is seen considerably higher in the short-term horizon, adding that longer-term inflation expectations are now re-anchored at the target level. Consumer prices, however, are seen declining in all scenarios, Lagarde added.

Lagarde also blamed energy as the main factor behind elevated inflation, noting at the same time that food prices could face upside pressure as well.

Regarding the normalization of the monetary conditions, Lagarde ruled out any acceleration of the process, favouring instead a gradual approach.

In the US, in the meantime, inflation tracked by the CPI rose in line with expectations at 7.9% YoY in February, while Core CPI rose 6.4% from a year earlier.

EUR/USD levels to watch

So far, spot is retreating 0.54% at 1.1014 and faces the next up barrier at 1.1121 (weekly high Mar.10) seconded by 1.1192 (20-day SMA) and finally 1.1285 (55-day SMA). On the other hand, a drop below 1.0805 (2022 low Mar.7) would target 1.0766 (monthly low May 7 2020) en route to 1.0727 (monthly low Apr. 24 2020).