USD/CAD Price Analysis: Bulls are moving in at critical H1 support

- USD/CAD is trading technically heavy, but inverse H&S offers solace for the bulls.

- Today's lows could be important in this regard while 1.2610 will be the last defence.

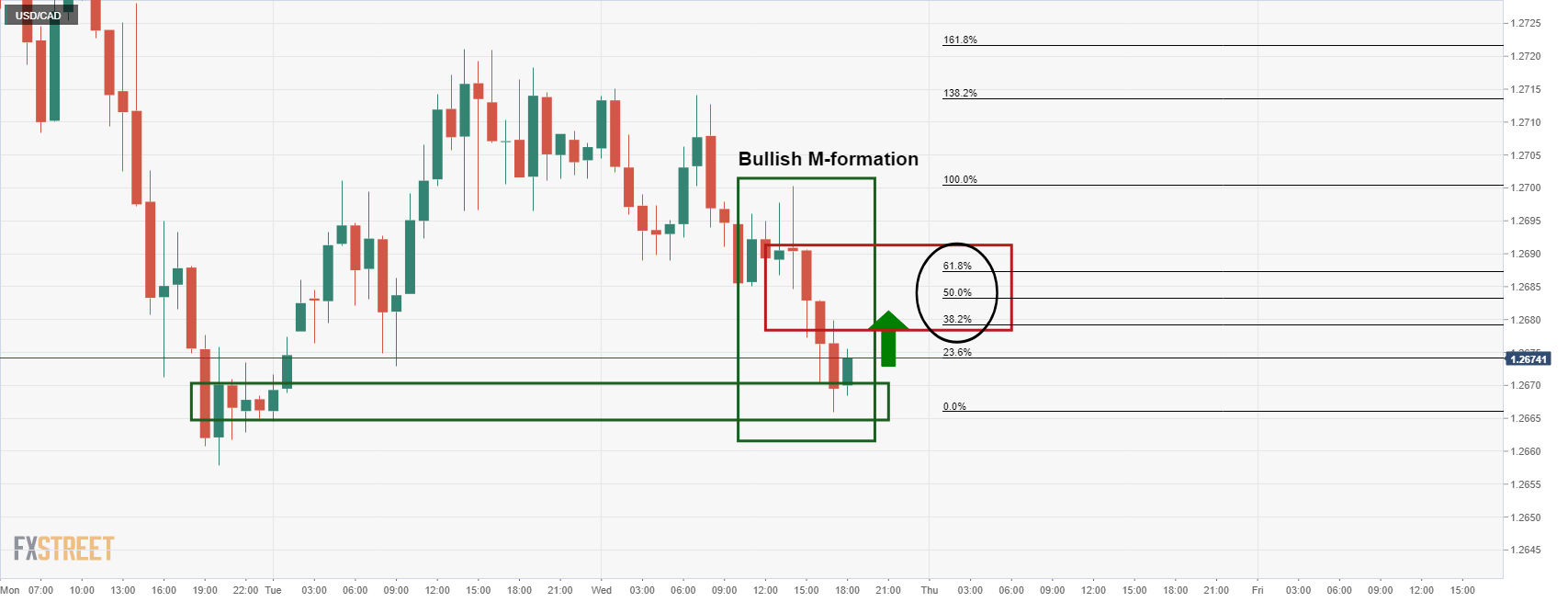

USD/CAD has been offered on the day but is running into a very important area of support. From a short-term perspective, the price is printing an overextended M-formation on the hourly chart:

USD/CAD H1 chart

The bulls are moving in as profits are taken off the table before the close of the North America session as traders will be keen to be square in the run-up to the critical US Consumer Price Index event in Thursday's morning New York trade. This raises prospects of a correction into the neckline of the M-formation where bulls can target the 1.2680's, namely the 38.2%, 50% and 61.8% ratios.

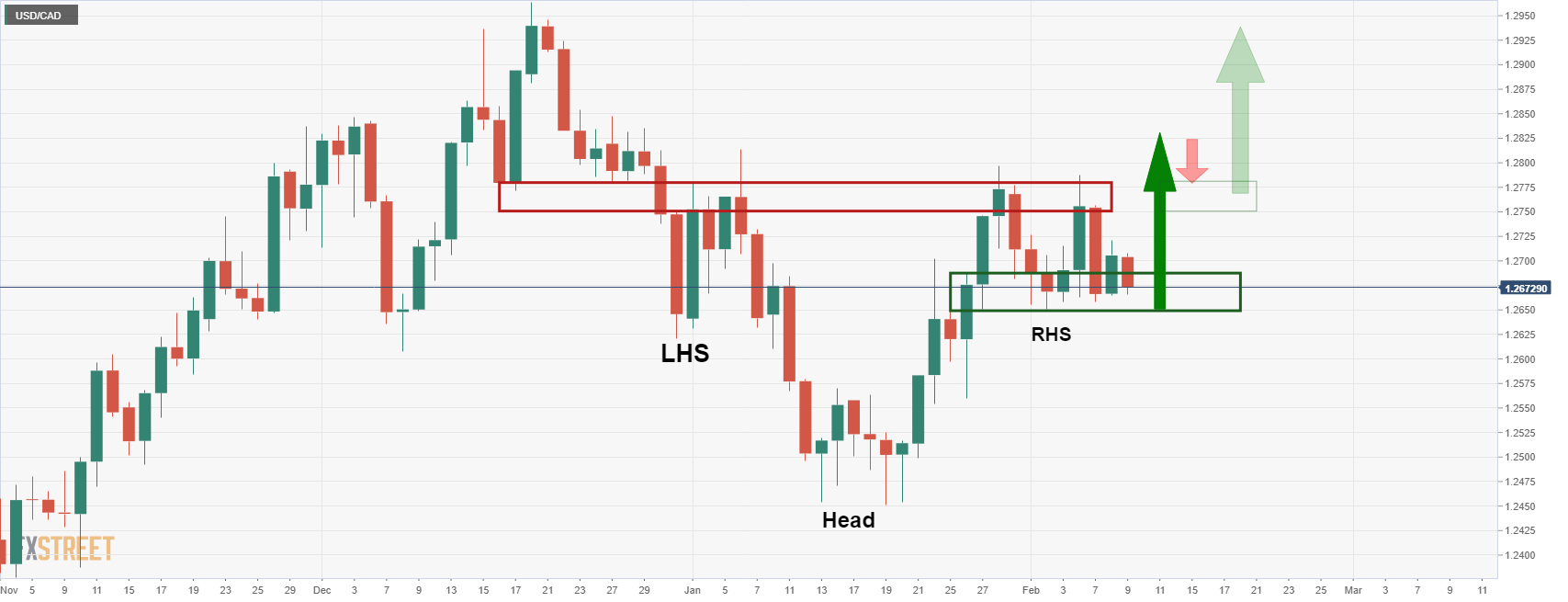

USD/CAD daily chart

Meanwhile, as per the prior analysis, USD/CAD Price Analysis: Bulls failed to break out, but Inverse H&S could now be the ticket, there is the case for the upside given the inverse H&S.

Therefore, it will be imperative that the shorter-term time frame support structures hold up under the current pressure. Today's lows could be important in this regard. 1.2610 will be the last defence otherwise.