Back

25 Jan 2021

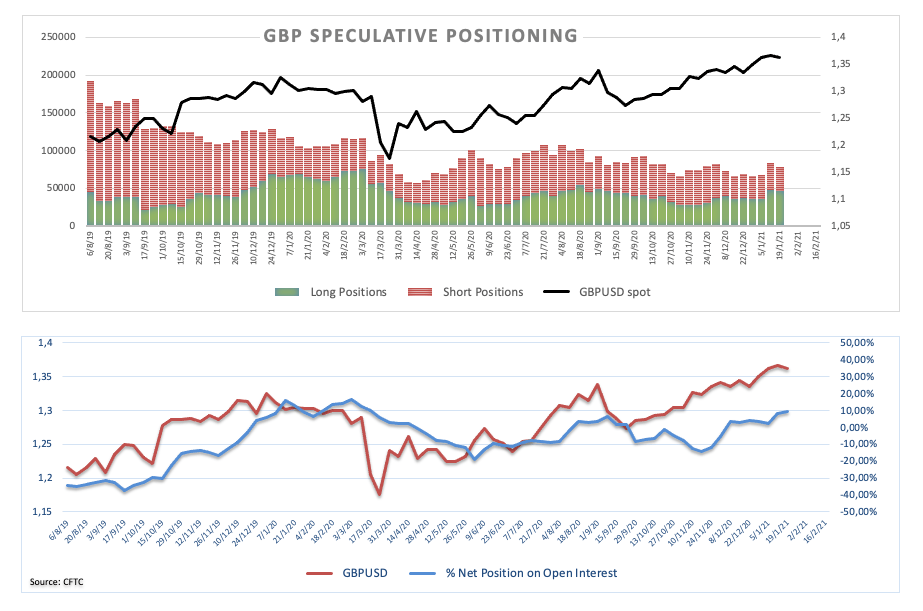

CFTC Positioning Report: GBP net longs climbed to multi-month highs

These are the main highlights of the CFTC Positioning Report for the week ended on January 19th:

- Net longs in the sterling rose to levels last seen in mid-March 2020 mainly on the back of renewed weakness surrounding the dollar. In addition, investors seem to be adjusting to the possibility that the Bank of England finally refrains from moving into negative rates coupled with lasting optimism in the wake of the EU-UK deal.

- Speculators added gross longs to their EUR positions for the fifth consecutive week, taking net longs to the highest level since October 20, 2020. Once again, the broad-based selling pressure in the greenback as well as an anticipated steady stance by the ECB at its meeting on Thursday motivated traders to keep the positive view on the single currency.

- JPY net longs eased to 3-week lows following the moderate rebound in US yields and increasing prospects ts of extra US fiscal stimulus.

- Net longs in crude oil receded to levels observed in mid-November 2020 against the backdrop of rising coronavirus restrictions (particularly in China) and the probable impact on growth projections and demand for the commodity.