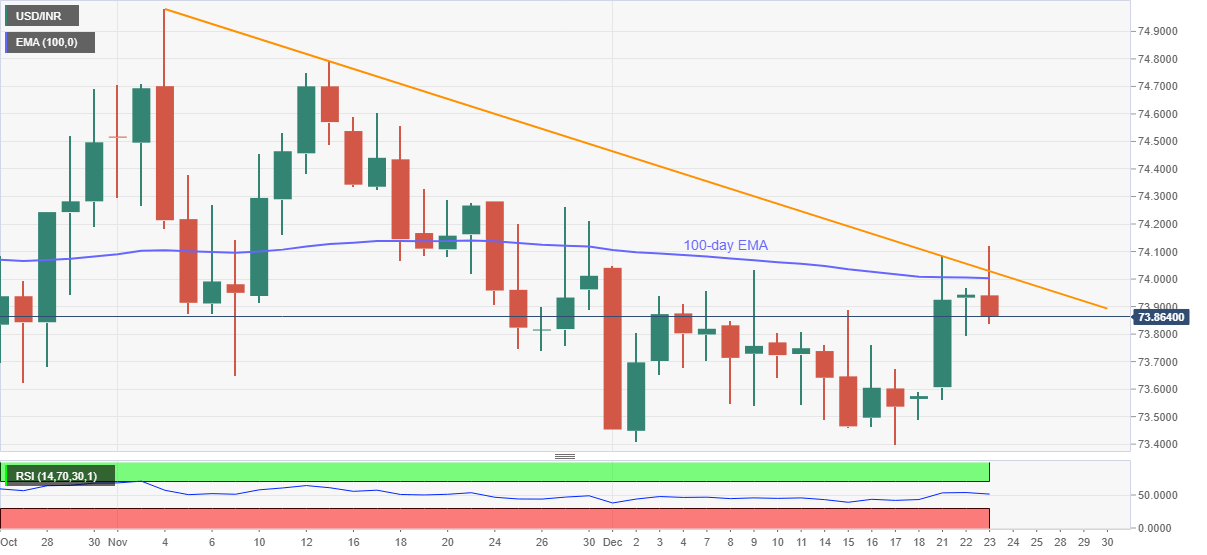

USD/INR Price News: Indian rupee bulls cheer another pullback from 100-day EMA

- USD/INR drops back below 74.00, defies uptick beyond seven-week-old resistance line.

- Normal RSI conditions, strong resistance favor sellers until the quote stays below 74.00.

- Bulls will have multiple upside hurdles beyond trend line resistance.

USD/INR wavers around the intraday low of 73.83, currently down 0.12% on a day near 73.85, during the initial Indian session trading on Wednesday. In doing so, the pair sellers benefit from the broad US dollar weakness as well as failures to cross a falling trend line from November 04 and 100-day EMA.

Considering the absence of extreme RSI conditions, coupled with sustained trading below key resistance, USD/INR can extend recent losses towards the early November bottom around 73.65.

Though, the monthly low near 73.40 and the 73.00 can lure the bears in case of the quote refrains from bouncing off 73.65.

Alternatively, 100-day EMA near 74.00, quickly followed by the stated resistance line around 74.05, can keep the USD/INR buyers in check.

It should, however, be noted that a daily closing beyond 74.05 will have to cross multiple hurdles around 74.25/30, comprising late November tops, before assuring the shift in the downtrend.

USD/INR daily chart

Trend: Bearish