Back

16 Oct 2020

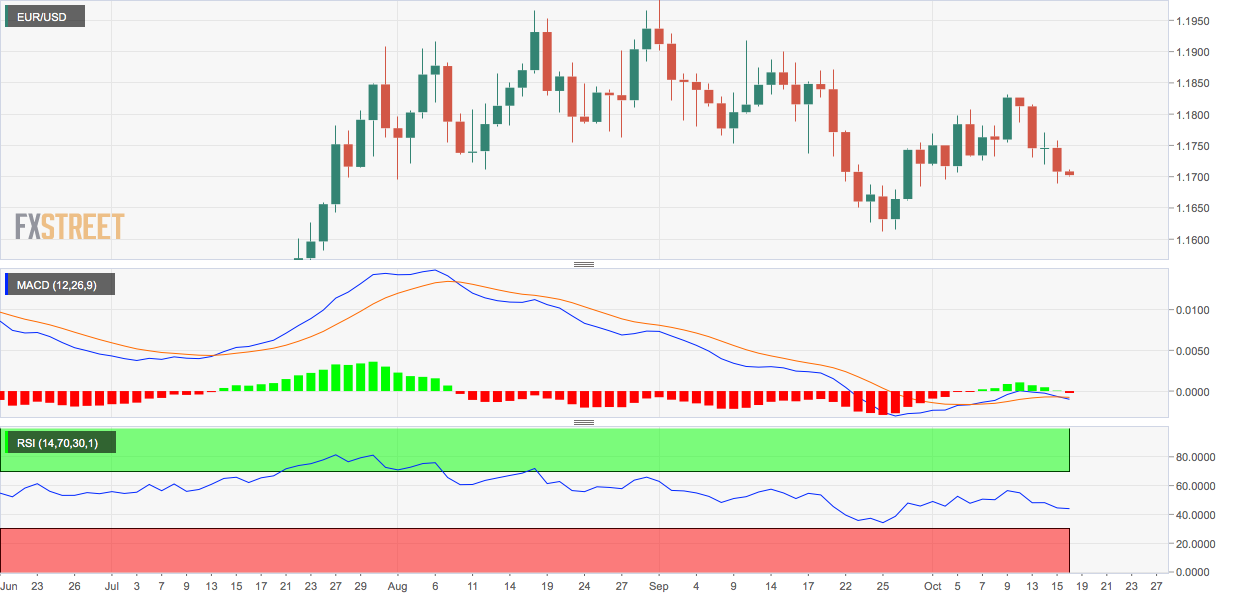

EUR/USD Price Analysis: On the defensive near 1.17 as key indicator turns bearish

- EUR/USD has declined by over 100 pips over the past five trading days.

- The daily chart indicators signal scope for deeper declines.

EUR/USD looks set to extend the recent sell-off, as the MACD histogram, an indicator used to gauge trend strength and trend changes, has crossed into a bearish territory below zero.

The 14-day relative strength index, too, is biased bearish with a below-50 print.

The pair is currently trading near 1.17 – down 130 pips from the high of 1.1831 registered last Friday. Support is seen at 1.1612 (Sept 25 low) and 1.1602 (100-day SMA).

On the higher side, a close above last Friday's high of 1.1831 is needed to invalidate bearish pressures and put the bulls back into the driver's seat.

Daily chart

Trend: Bearish

Technical levels