USD/JPY Price Analysis: Range play continues, forms a strong base near 100-hour SMA

- USD/JPY remains confined in a multi-day-old trading range below mid-107.00s.

- Mixed technical set-up warrants some caution before placing any directional bets.

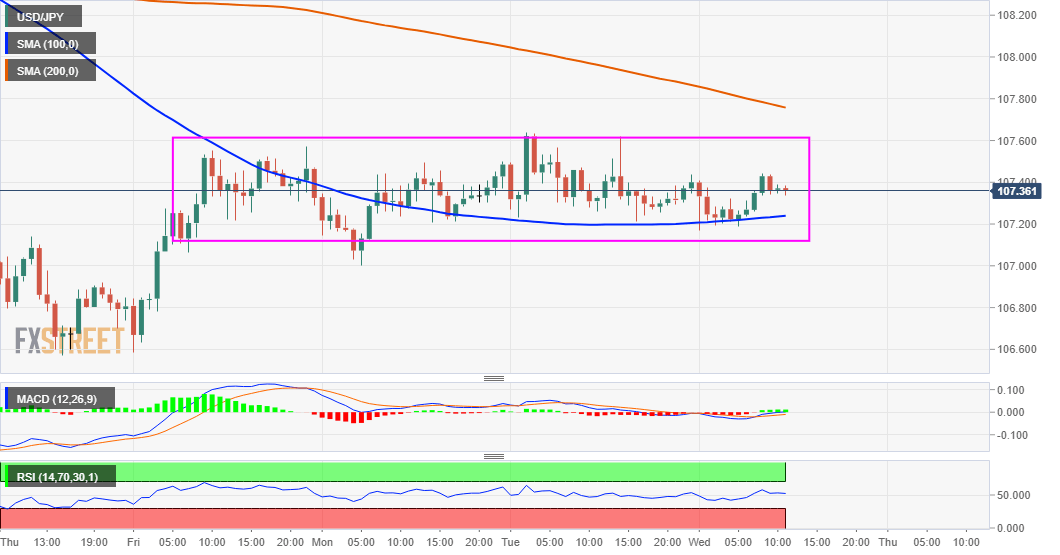

The USD/JPY pair extended its sideways consolidative price move for the third consecutive session on Wednesday and remained confined in a narrow band below mid-107.00s.

The range-bound trading action now seemed to have constituted towards the formation of a rectangle, which is seen as a continuation pattern and marks a pause in the trend. The set-up points to an extension of the recent sharp fall from the vicinity of the key 110.00 psychological mark.

The pair, however, has managed to find acceptance, rather formed a strong base above the 100-hour SMA. This, in turn, supports prospects for some meaningful near-term appreciating move amid the prevalent upbeat market mood, which tends to undermine the safe-haven Japanese yen.

Meanwhile, neutral oscillators on hourly/daily charts haven't been supportive of any firm near-term direction and further warrant some caution for aggressive traders. This makes it prudent to wait for a sustained break in either direction before positioning for the pair's near-term trajectory.

A convincing break below 100-hour SMA, currently near the 107.25-20 region, leading to a subsequent weakness below the 107.00 mark will be seen as a fresh trigger for bearish traders. The pair might then accelerate the fall towards retesting the recent swing lows, around the 106.60-55 region.

On the flip side, the 107.60 level now seems to have emerged as immediate strong resistance and is closely followed by 200-hour SMA, around the 107.75 region. A sustained strength beyond the mentioned levels should lift the pair beyond the 108.00 mark towards the 108.20-25 supply zone.

USD/JPY 1-hourly chart

Technical levels to watch