Back

26 Nov 2019

GBP/USD Technical Analysis: Downside calling, trading sub-1.2900 figure

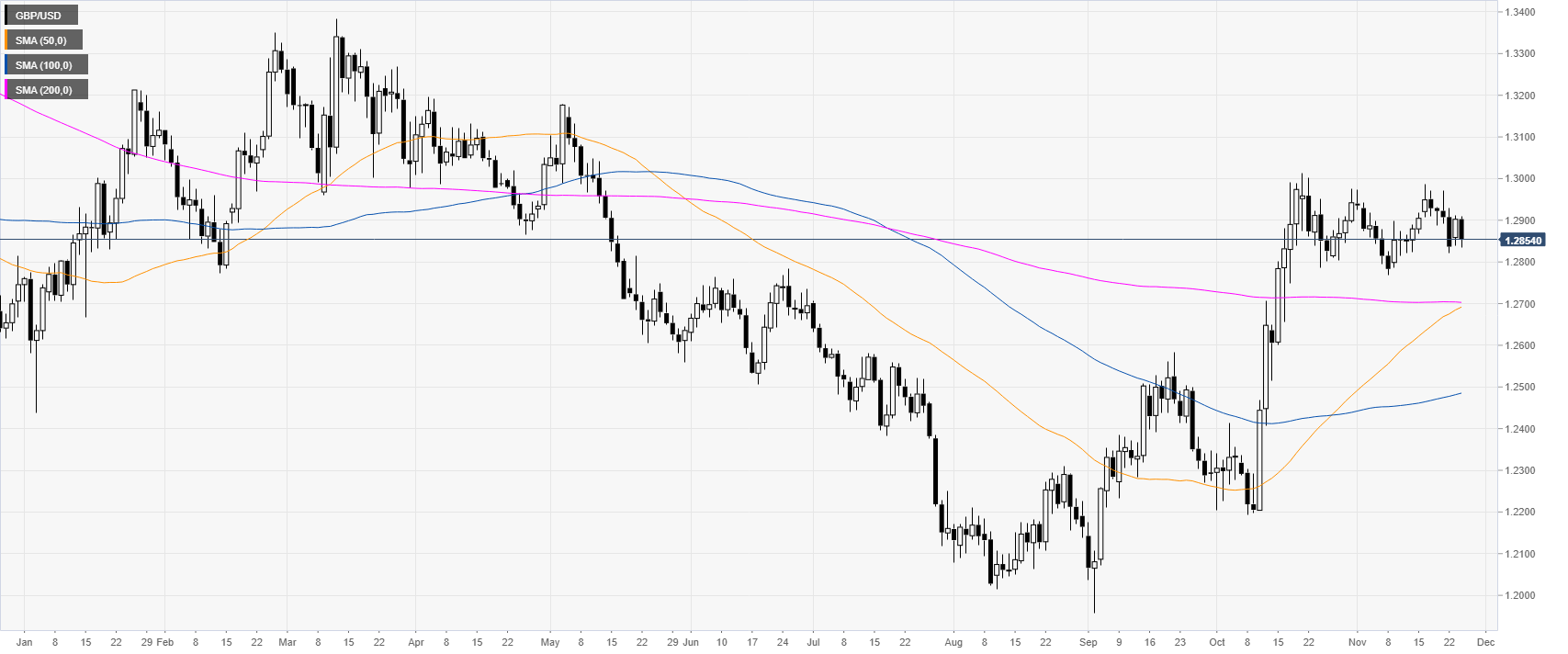

- The cable is trading near its lowest point since the start of the week.

- The level to beat for sellers is the 1.2820 level.

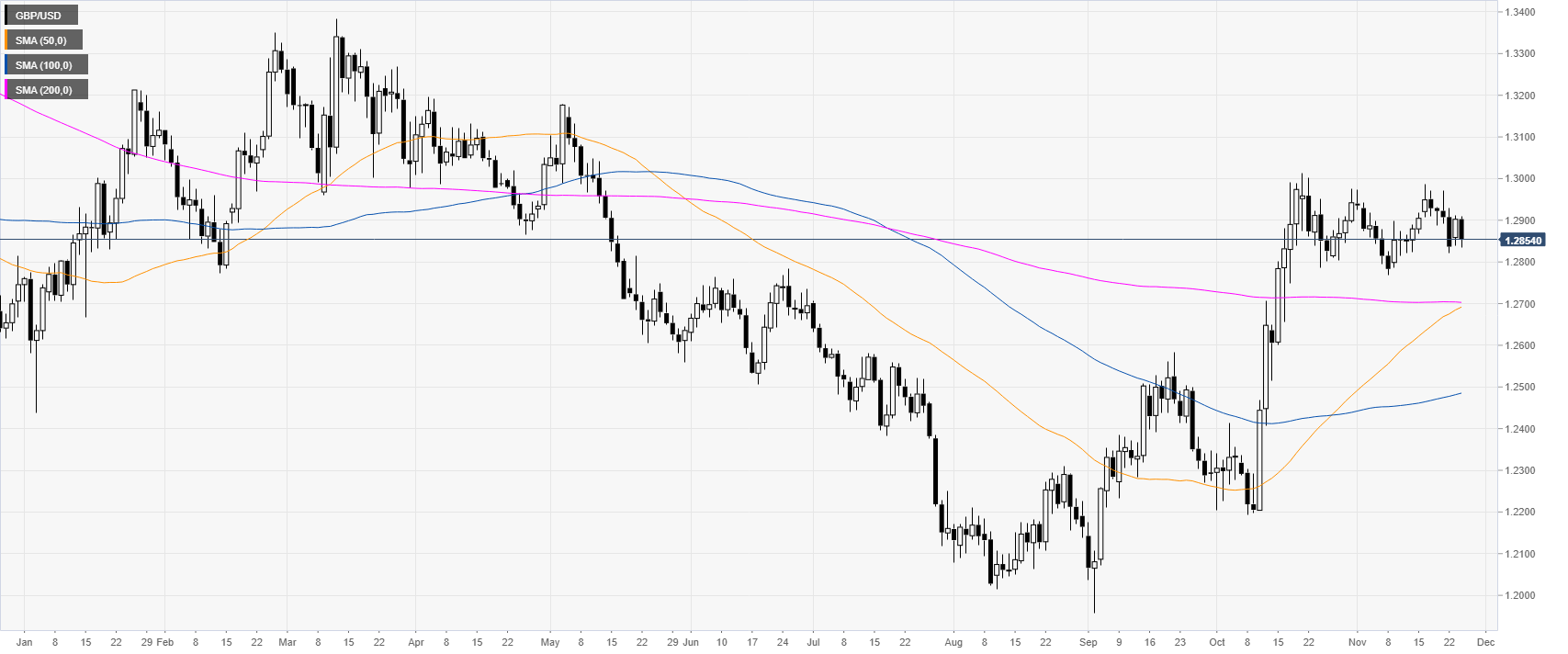

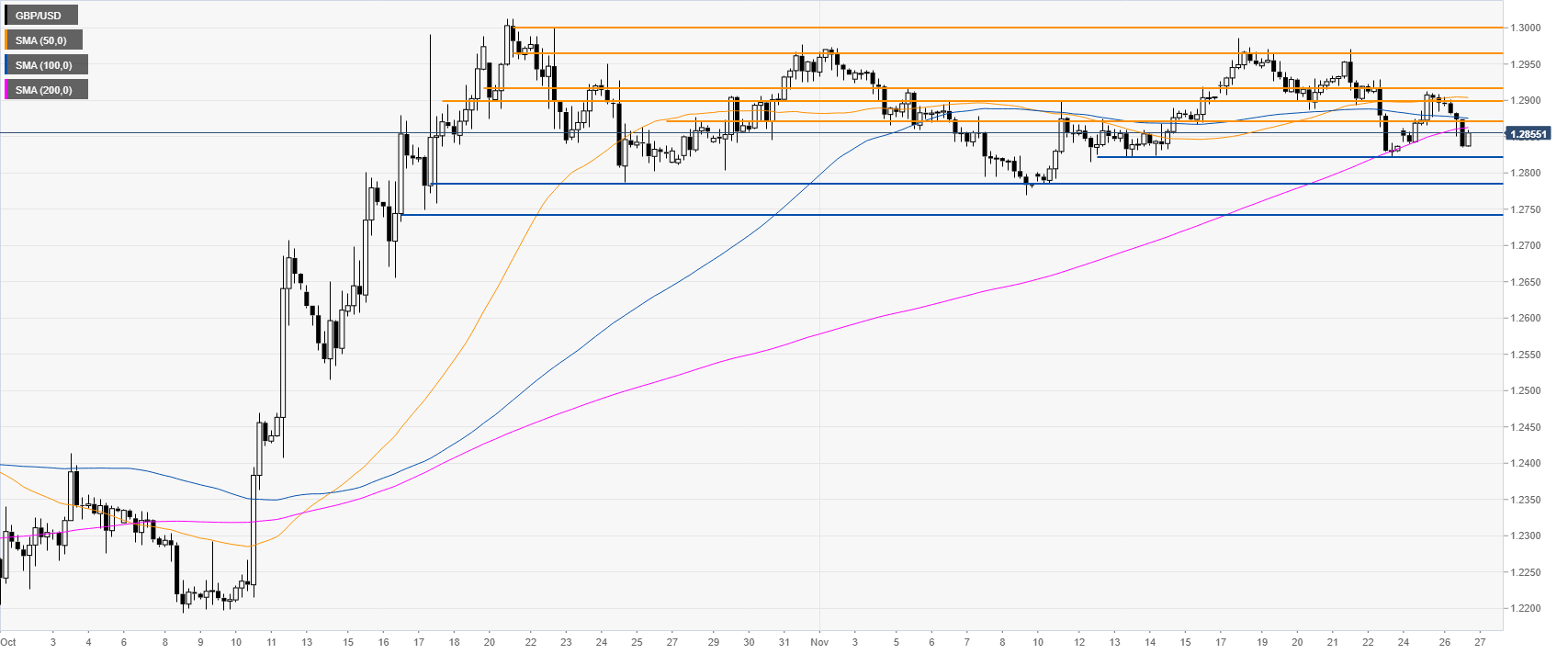

GBP/USD daily chart

GBP/USD is fighting for the 1.2900 handle as the market is consolidating in November. However, the spot keeps an underlying bullish momentum while trading above its main daily simple moving averages (DMAs).

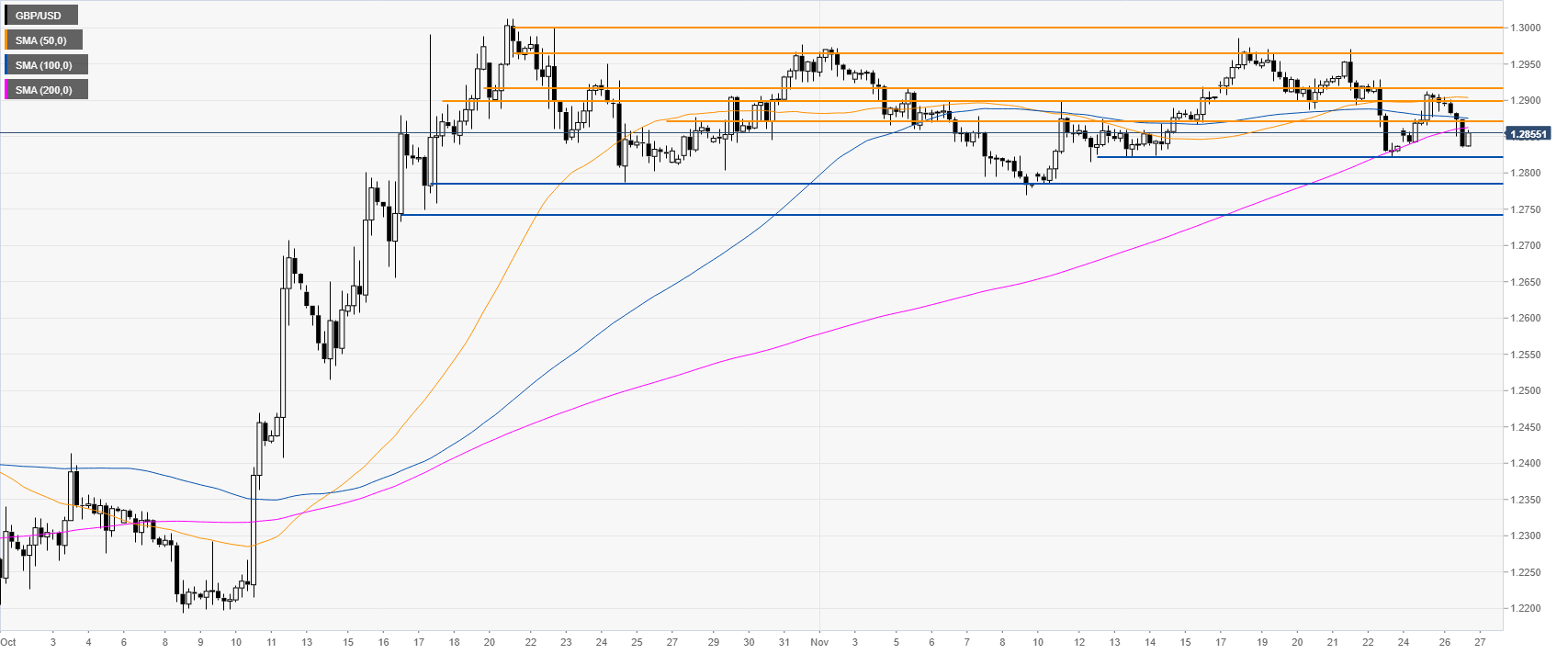

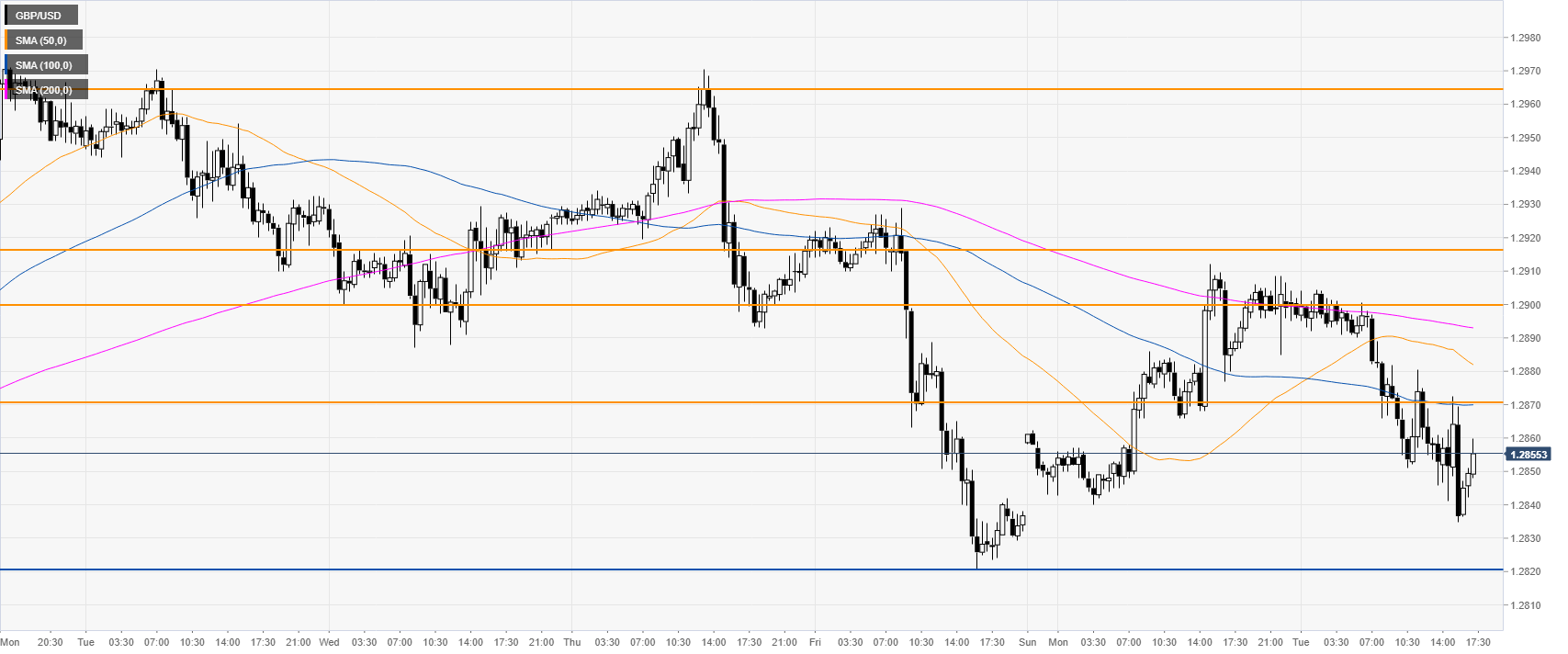

GBP/USD four-hour chart

The spot is trading below the 1.2900 figure and its main SMAs, suggesting a bearish bias in the medium term. A break below 1.2820 should trigger further weakness towards the 1.2785 and 1.2742 price levels, according to the Technical Confluences Indicator.

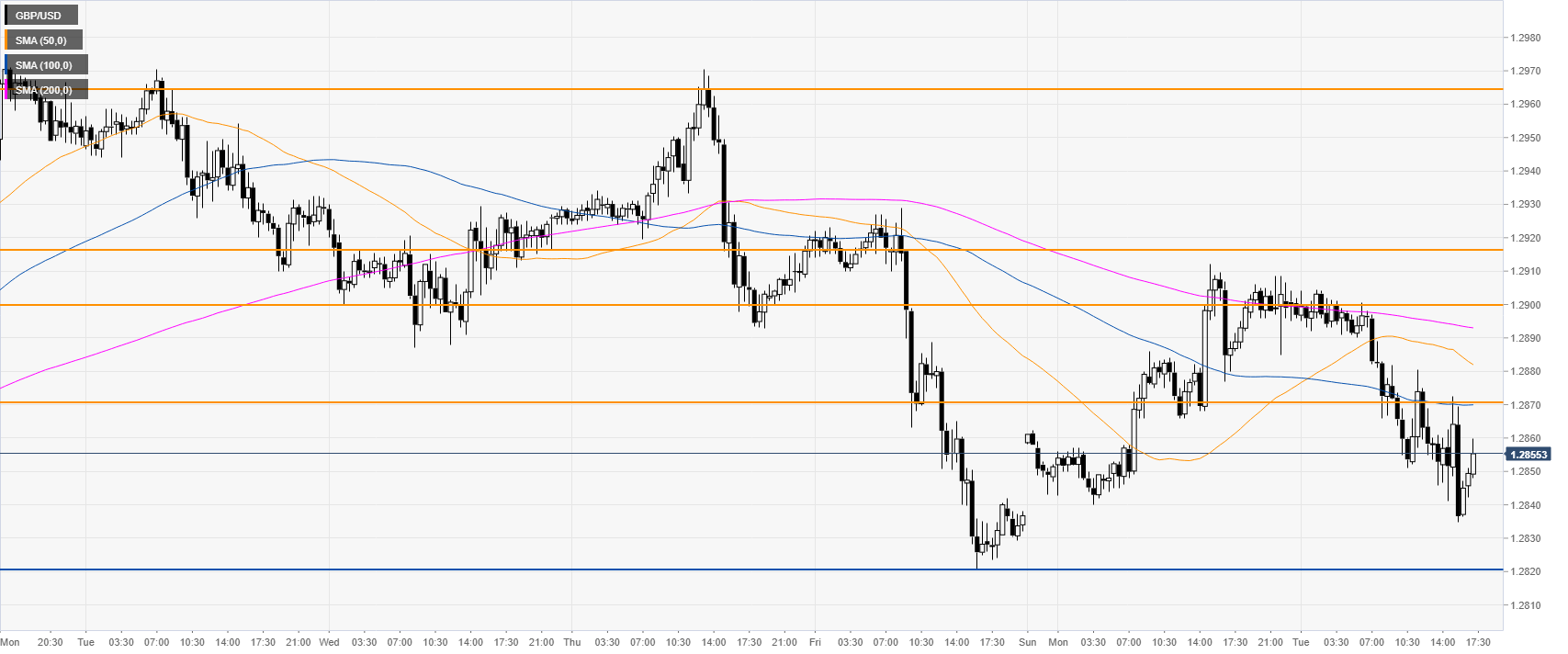

GBP/USD 30-minute chart

Sterling is trading below its main SMAs, suggesting a bearish bias in the short term. Resistance is expected at 1.2870 and the 1.2900/1.2910 price zone, according to the Technical Confluences Indicator.

Additional key levels