Back

5 Nov 2019

EUR/USD technical analysis: Euro trades at five-day low as US ISM Non-Manufacturing PMI comes better-than-expected

- ISM Non-Manufacturing PMI rebounds to 54.7, EUR/USD extends slide to 1.1072.

- The level to beat for bears is the 1.1072 swing low.

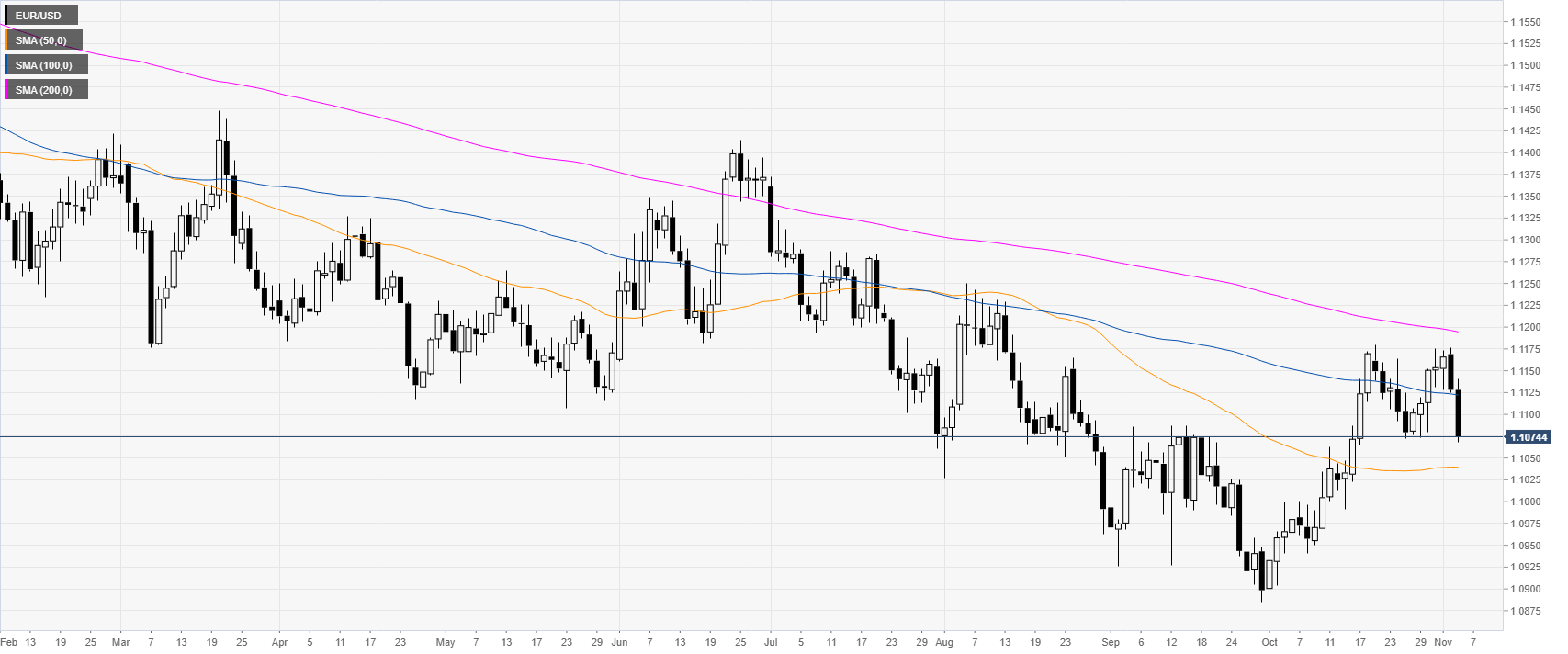

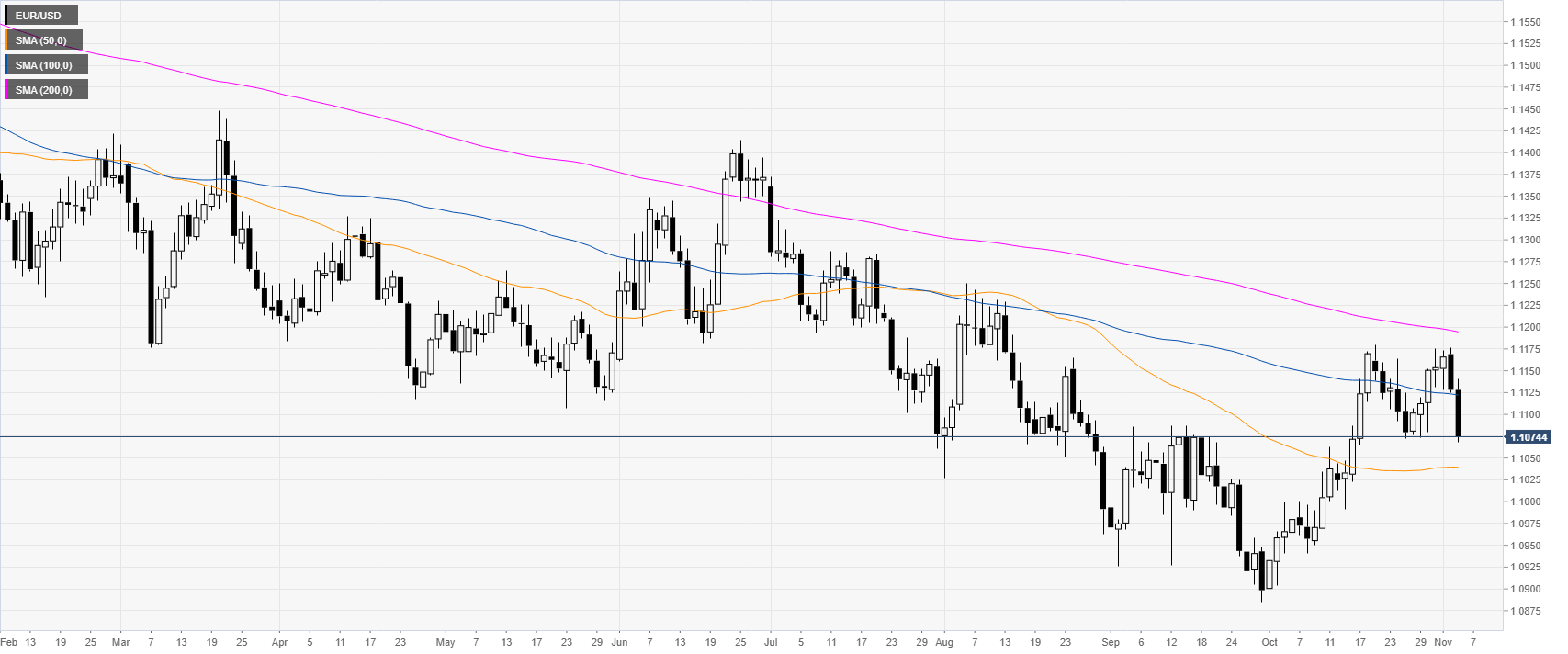

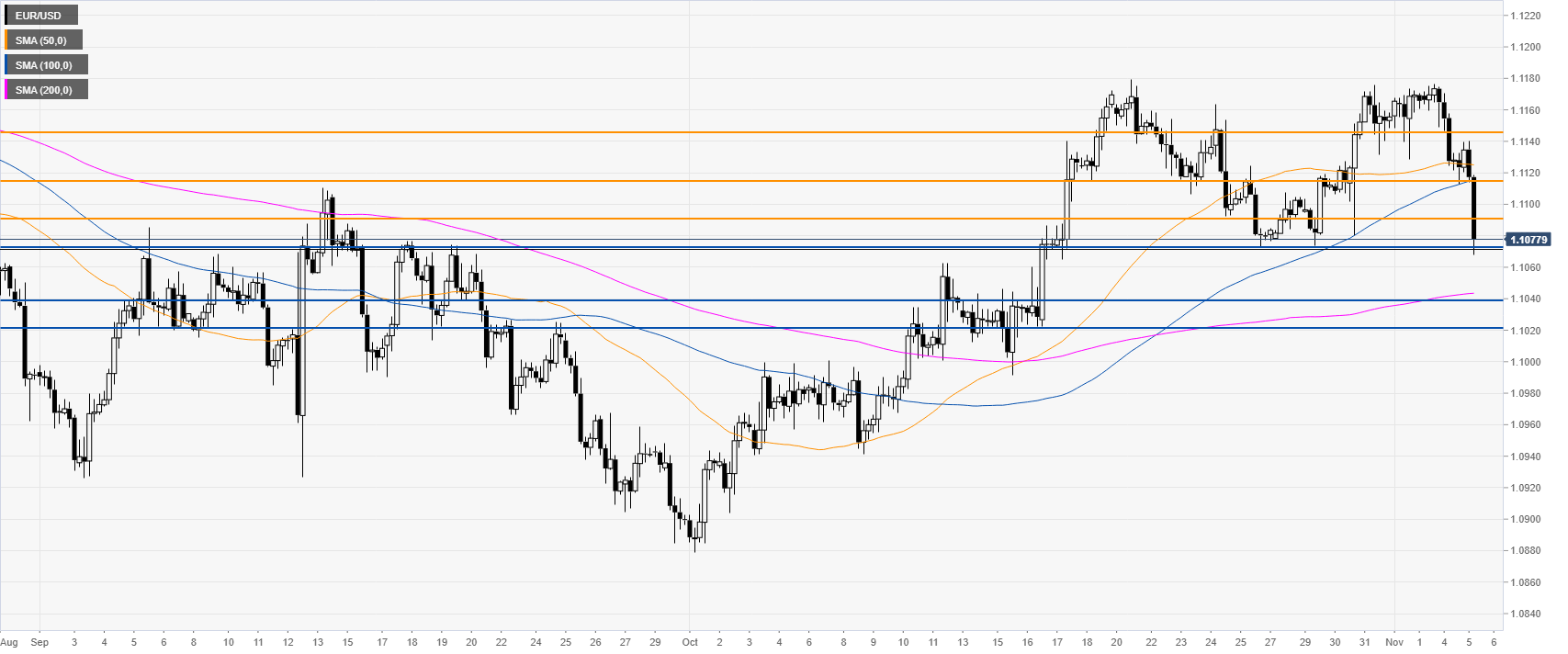

EUR/USD daily chart

On the daily chart, the Euro is trading in a downtrend below its 200-day simple moving average (DMA) while challenging the 100 DMA. This Monday, the ISM Non-Manufacturing PMI rebounds to 54.7, EUR/USD extends slide to 1.1072.

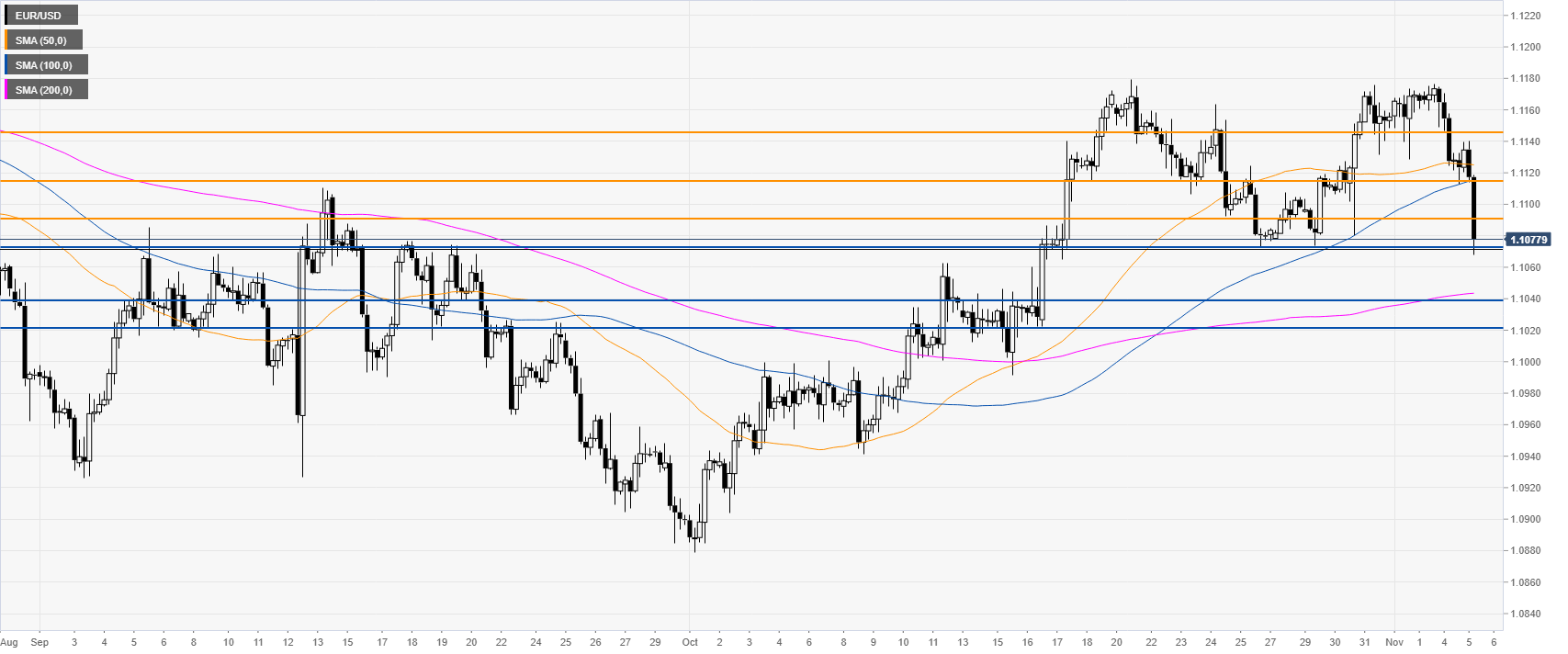

EUR/USD four-hour chart

The Euro is challenging the 1.1072 swing low while trading below the 50 and 100 SMAs. A daily break below the level can open the doors to more losses towards the 1.1037/20 support zone, according to the Technical Confluences Indicator.

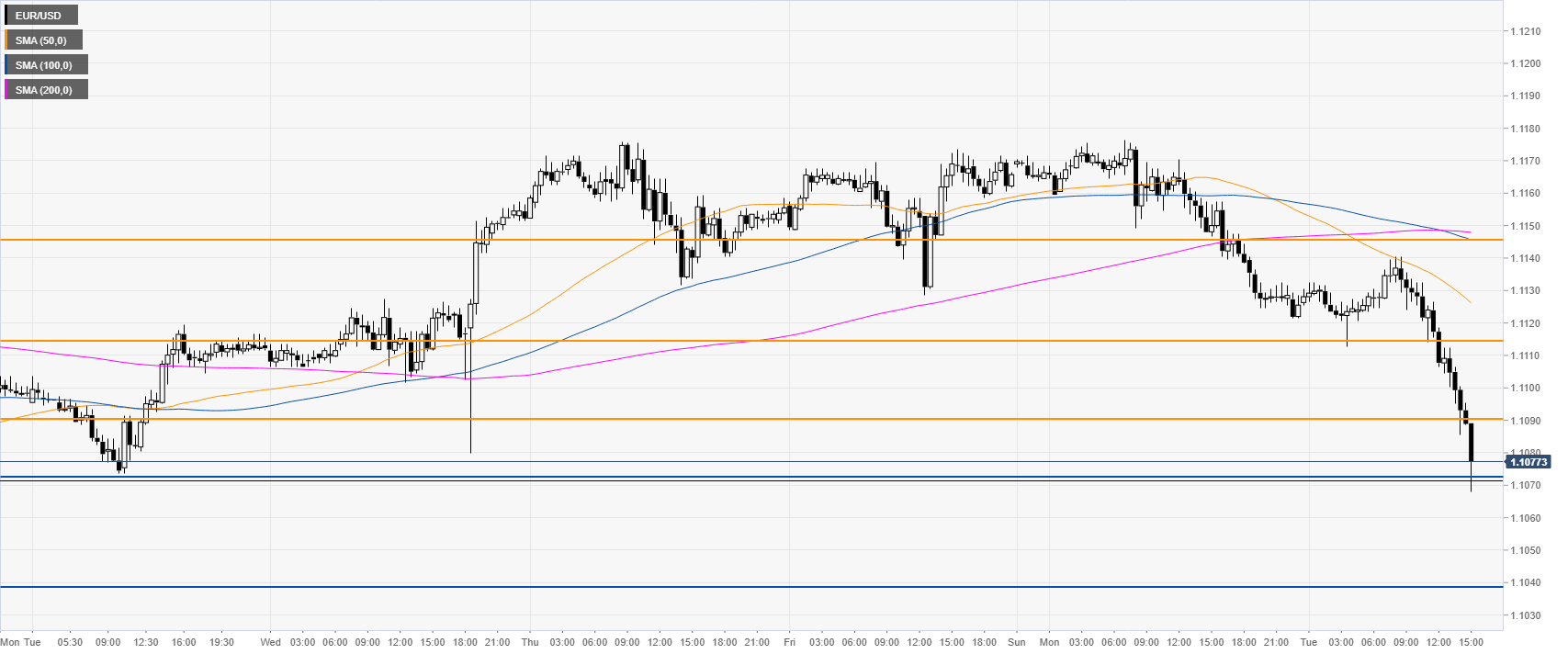

EUR/USD 30-minute chart

EUR/USD is trading at five-day lows below its main SMAs, suggesting a bearish bias in the near term. Resistance is seen at the 1.1090 level followed by the 1.1115 and 1.1145 levels, according to the Technical Confluences Indicator.

Additional key levels