Back

21 Oct 2019

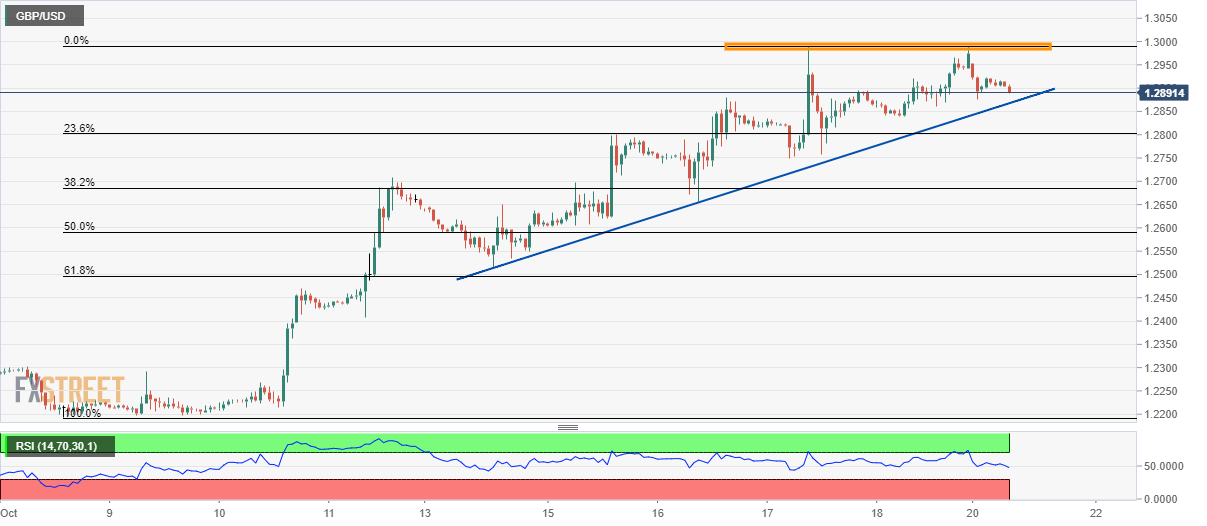

GBP/USD technical analysis: Buyers rely on short-term ascending triangle

- GBP/USD inches closer to the one-week-old rising support line.

- “Double top” formation around 1.2988/90 caps immediate upside.

The GB/USD pair’s pullback from last week's “double tops” seems to have little downside as a week old rising trend line stands tall to challenge sellers. The pair declines to 1.2894 by the press time that precedes the London open on Monday.

While seeing together, a short-term symmetrical triangle between 1.2867 and 1.2990 is likely the key for the pair traders with the falling level of 14-bar Relative Strength Index (RSI) also favoring a bounce from near-term key support line.

Should prices fail to bounce off 1.2867, 1.2700 and mid-month bottoms close to 1.2515 will gain sellers’ attention.

On the upside, 1.3000 can validate the pair’s run-up beyond 1.2990.

In doing so, May month high close to 1.3180 could lure bulls.

GBP/USD hourly chart

Trend: bullish