GBP/JPY technical analysis: Multiple upside barriers on the road to recovery

- GBP/JPY remains positive above 23.% Fibonacci retracement.

- 134.83/95 stands first in the series of resistances comprising trend-line and key moving averages.

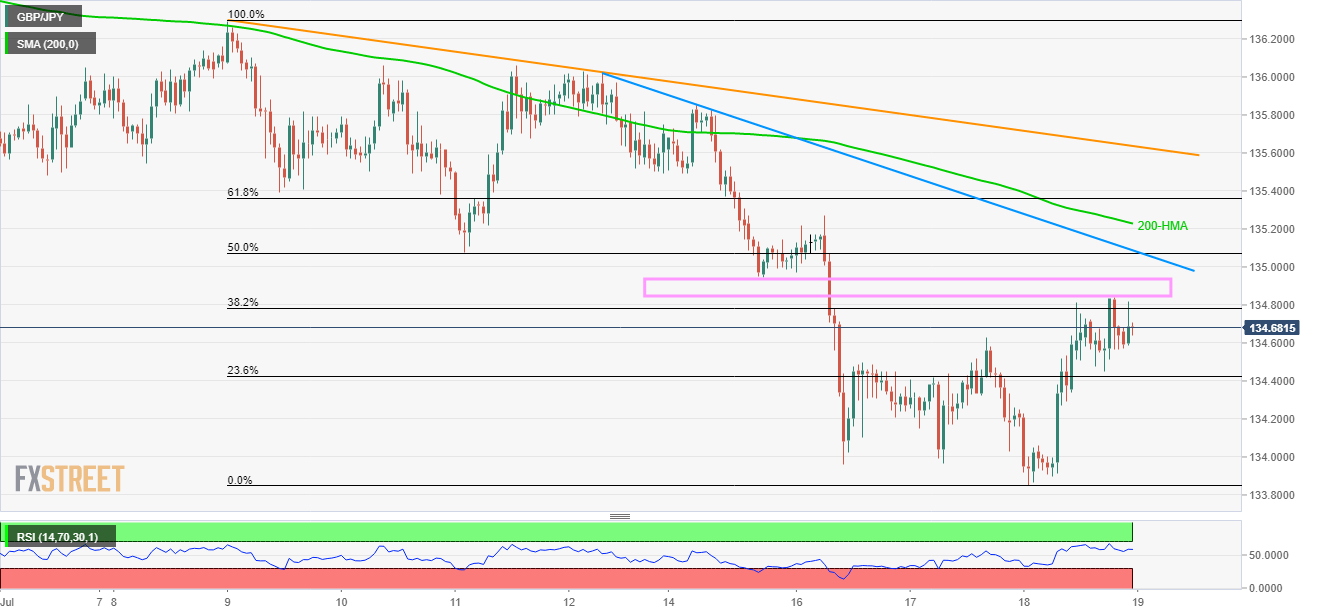

Despite successfully trading above 23.6% Fibonacci retracement of a recent downpour, the GBP/JPY pair lags behind many key resistances as it takes the rounds to 134.70 during the early Asian session on Friday.

The 134.83/95 area comprising Thursday’s top and July 15 low becomes the first resistance buyers have to clear ahead of confronting a week-long descending trend-line at 135.10.

Should prices rally past-135.10, 200-hour moving average (200-HMA) around 135.23 and 61.8% Fibonacci retracement level of 135.36 hold the keys to 7-day long descending trend-line at 135.65.

Alternatively, the pair’s decline below 23.6% Fibonacci retracement level of 134.43 might not refrain from highlighting the latest low of 133.85 for sellers.

GBP/JPY hourly chart

Trend: Pullback expected