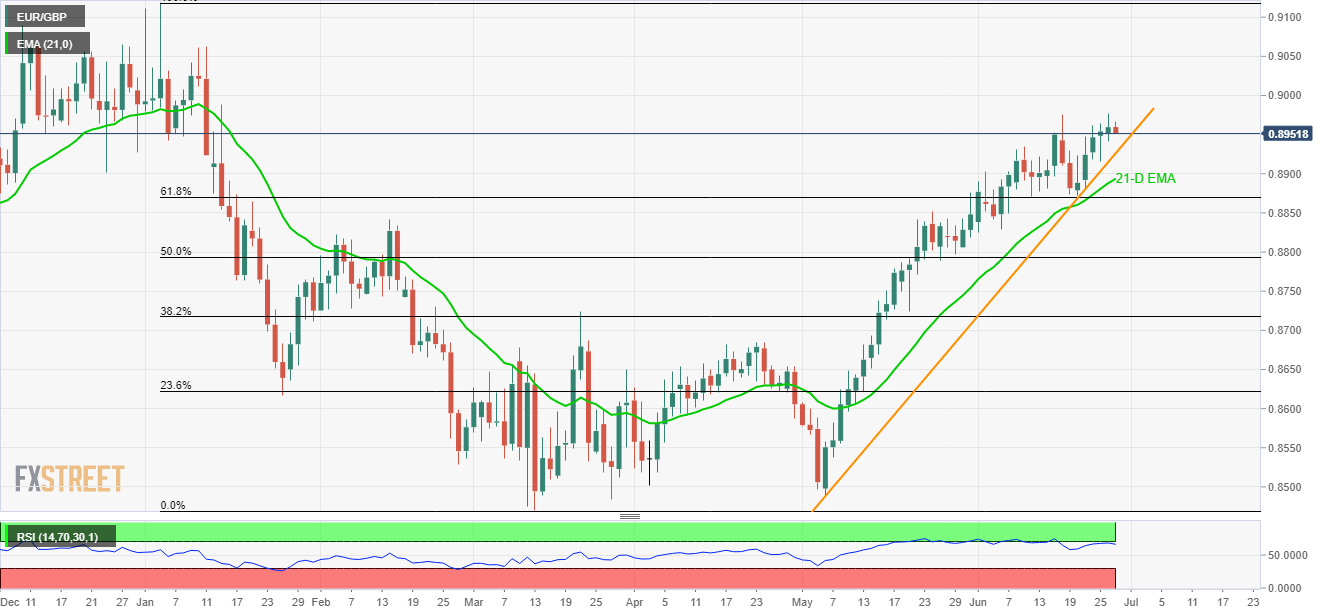

EUR/GBP technical analysis: Overbought RSI favors pullback, 7-week old support-line limits the dip

- Overbought RSI limits the EUR/GBP’s capacity to rise past-monthly top.

- An upward sloping trend-line since early-May limits near-term declines.

Failure to grow much beyond the monthly high, coupled with overbought levels of 14-day relative strength index (RSI), drag the EUR/GBP pair presently down to 0.8952 heading into the European open on Thursday.

Having said that, a 7-week old support-line at 0.8926 gains sellers’ immediate attention, while the 21-day exponential moving average (21-D EMA) at 0.8894 and 61.8% Fibonacci retracement of January to March dip around 0.8870, may please the bears afterward.

In a case where prices keep trading southwards past-0.8870, February month top near 0.8842 and 50% Fibonacci retracement level at 0.8794 may come back on the chart.

It should, however, be noted that the quote’s successful rally beyond 0.8975/77 area, including latest tops, can flash 0.9000 for buyers whereas 0.9060 and 0.9120 can please them during further advances.

EUR/GBP daily chart

Trend: Pullback expected