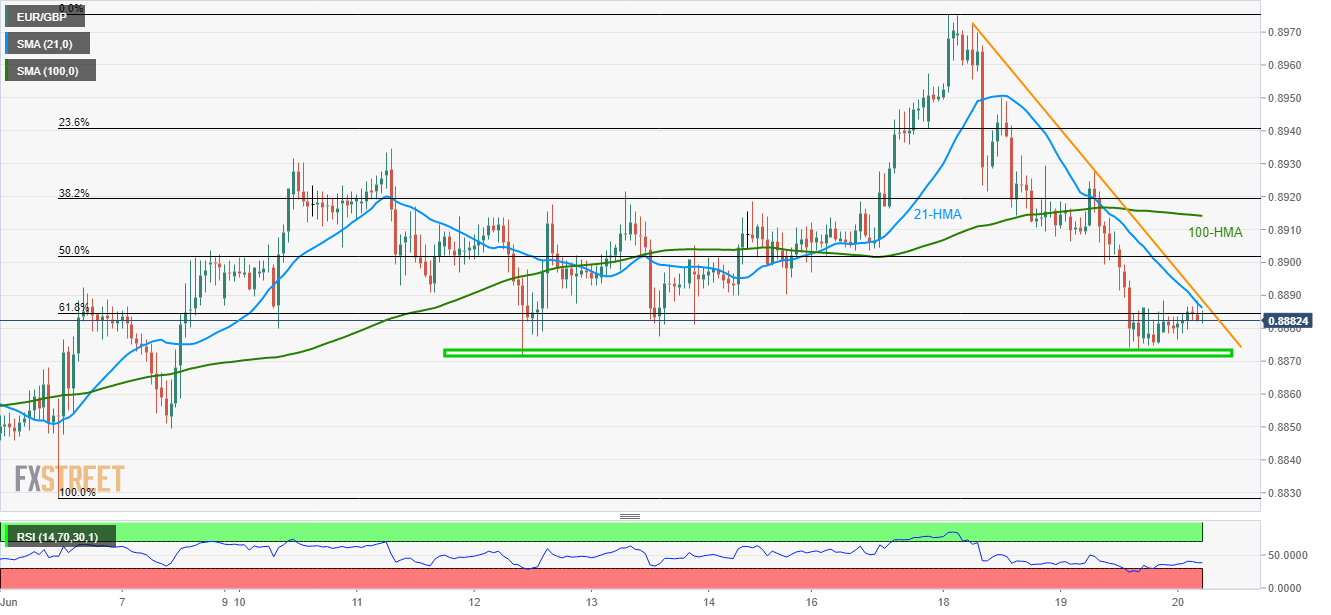

EUR/GBP technical analysis: Sellers keep lurking around 21-HMA, immediate resistance-line

- Nearby resistance confluence challenges the latest U-turn from horizontal support.

- 100-HMA can please buyers during upside break while sellers can aim for 0.8850 during extra declines.

Despite bouncing off near-term important support-zone, the EUR/GBP pair fails to cross the key resistance-confluence comprising 21-HMA and 2-day long trend-line, as it trades near 0.8885 while heading into the European open on Thursday.

With the strength of upside barriers joining normal levels of 14-bar relative strength index (RSI), prices are more likely to break 0.8871/74 horizontal-support than rising over 0.8889/90 resistance-confluence.

In that case, low of June 07, near 0.8850, can offer an intermediate halt to the pair’s downpour towards 0.8828 rest-point.

If at all buyers take control and fuel the quote beyond 0.8890, 100-hour moving average (HMA) near 0.8915, followed by 0.8935, could be their next targets.

However, current month high around 0.8976 is likely a tough nut to crack for the bulls that hold the key to 0.9000 round-figure.

EUR/GBP hourly chart

Trend: Bearish