Gold Technical Analysis: The recent recovery move already seems to have run out of steam

• The precious metal extended overnight retracement slide from two-week lows and was weighed down by a combination of negative factors - a goodish pickup in the USD demand and fading safe-haven demand.

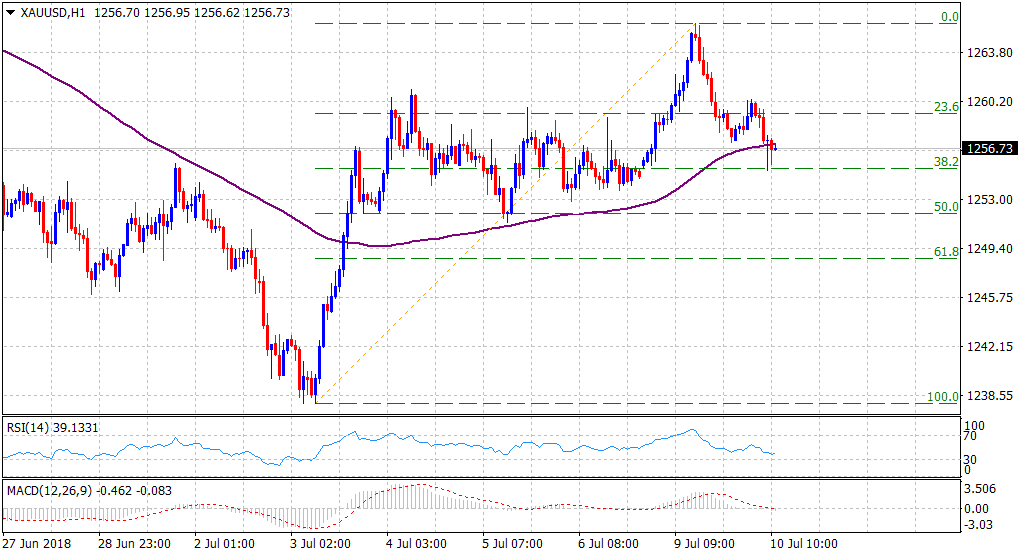

• With short-term technical indicators already seemed losing positive momentum, the fact that it has slipped back below 100-hour SMA, for the first time since last Tuesday, points to a bearish set-up.

• A follow-through weakness below 38.2% Fibonacci retracement level of the $1238-$1266 recent recovery move would add credence to the near-term negative outlook.

Gold 1-hourly chart

Spot Rate: $1256.73

Daily High: $1260.38

Daily Low: $1255.13

Trend: Bearish

Resistance

R1: $1259 (23.6% Fibo. retracement level)

R2: $1266 (overnight swing high)

R3: $1273 (an important support break-point)

Support

S1: $1252 (50% Fibo. retracement level)

S2: $1248 (horizontal zone)

S3: $1242 (recent daily closing low)