USD/CAD reverses and erases daily gains as oil pares losses

After rising to 1.3360 against the backdrop of falling crude oil prices, the USD/CAD pair reversed course and lost around 40 pips amid broad based USD weakness and the strong recovery seen in oil. At the moment, the pair is down 0.04% at 1.3321.

Earlier during the day, the loonie lost strength as the WTI started to correct yesterday's strong gains. However, after a recent report suggested that the OPEC complied 104% with output curbs in March, and Saudi Arabia wants OPEC to extend cuts, the crude oil prices quickly recovered the daily losses and moved back into the positive area. At the moment, the barrel of WTI is at $53.24, recording a daily gain of 0.3%.

- OPEC's 11 states with oil output targets comply 104% with curbs in March - RTRS

On the other hand, the US Dollar Index continues to suffer losses amid falling U.S. Treasury yields. As of writing, the DXY is down 0.32% at 100.62. Later in the session, FOMC's Kashkari's remarks will be watched closely.

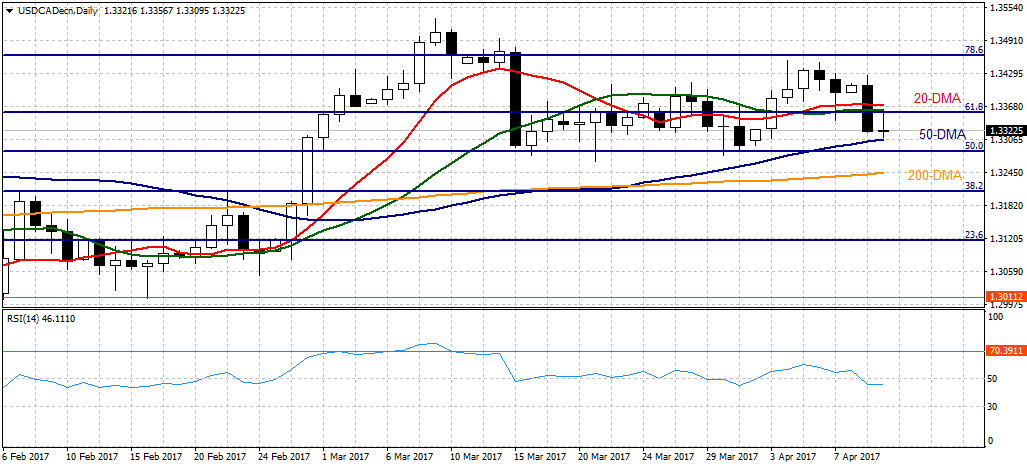

Technical outlook

The USD/CAD pair faces the first resistance at 1.3370 (20-DMA) and above that level, the pair could extend the rise towards 1.3425 (Apr. 10 high) and 1.3500 (psychological level). On the flip side, supports could be seen at 1.3300/05 (psychological level/50-DMA), 1.3245 (200-DMA) and 1.3200 (psychological level).