AUD/JPY Price Analysis: Falls to four-week lows amid strong JPY

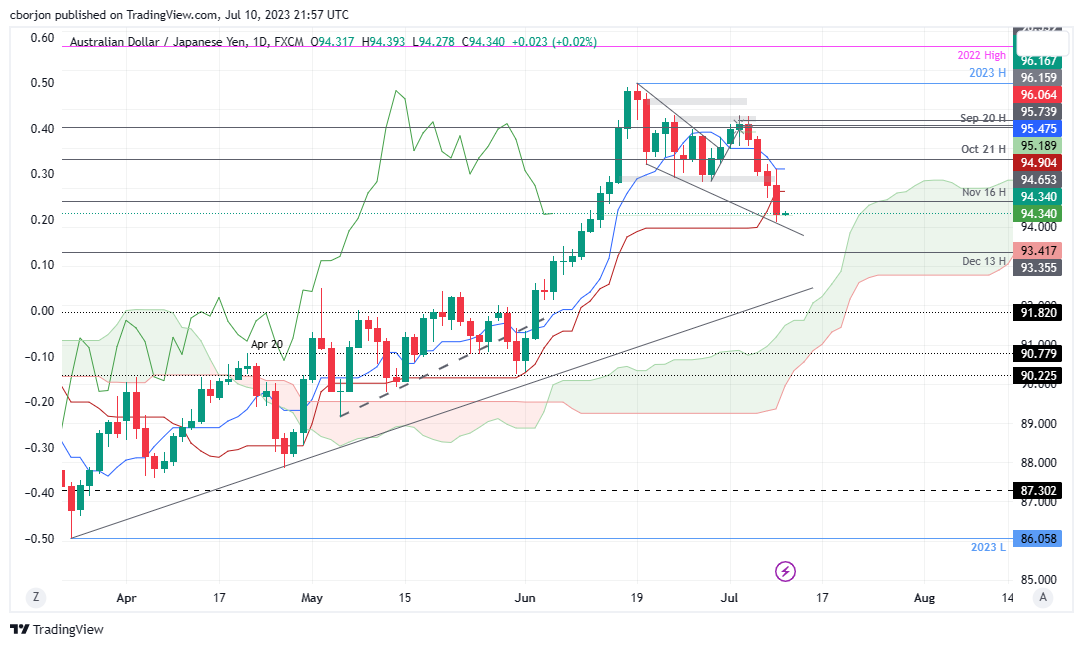

- AUD/JPY continues to lose ground, falling below the Kijun-Sen line and reaching a four-week low at 94.11.

- Despite recent losses, the pair maintains an upward bias, remaining above the Ichimoku Cloud.

- Key support levels to watch are at 94.00, followed by the Senkou Span B line at 93.41, and December 13 daily high turned support at 93.35. Breach of these could expose the 93.00 level.

- To reverse the trend, AUD/JPY buyers must reclaim the Kijun-Sen line at 95.18 and challenge the Tenkan-Sen line at 95.47.

AUD/JPY extended its losses below the Kijun-Sen line after sellers broke technical support levels at around 95.18 before cracking the former at 94.90. The AUD/JPY slid to a new four-week low at 94.11 before stabilizing around current exchange rates. At the time of writing, the AUD/JPY is trading at 94.32, down 0.03% as the Asian session begins.

AUD/JPY Price Analysis: Technical outlook

From a technical perspective, the AUD/JPY is still upward biased, as it remains above the Ichimoku Cloud, with the latest dip putting into play support levels not seen in a month. The 94.00 figure is next, followed by the Senkou Span B line at 93.41, and the December 13 daily high turned support at 93.35. If the cross falls below the latter, that could expose the 93.00 figure.

Conversely, the AUD/JPY buyers must reclaim the Kijun-Sen line at 95.18, so they can threaten to lift the pair above the Tenkan-Sen line at 95.47. In that outcome, the AUD/JPY's next resistance would be the October 21 high at 95.74, ahead of reaching the 96.00 mark.

AUD/JPY Price Action – Daily chart