Back

22 Feb 2023

Crude Oil Futures: A sustained retracement appears unlikely

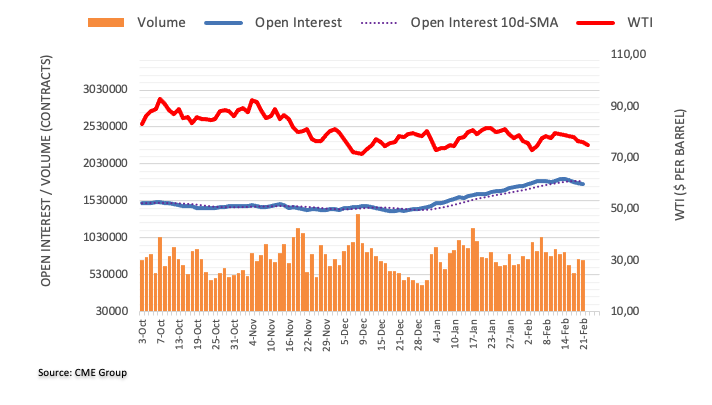

CME Group’s flash data for crude oil futures markets noted traders trimmed their open interest positions for the fourth session in a row on Tuesday, this time by around 11.2K contracts. In the same line, volume partially reversed the previous daily build and shrank by around 14.4K contracts.

WTI: A test of the 2023 low remains on the table

Prices of the barrel of the WTI resumed the downtrend on Tuesday amidst dwindling open interest and volume, which hints at the likelihood that a convincing decline seems out of favour for the time being. That said, the next support of note for the commodity remains at the YTD low at $72.30 (February 6).