Back

23 Dec 2022

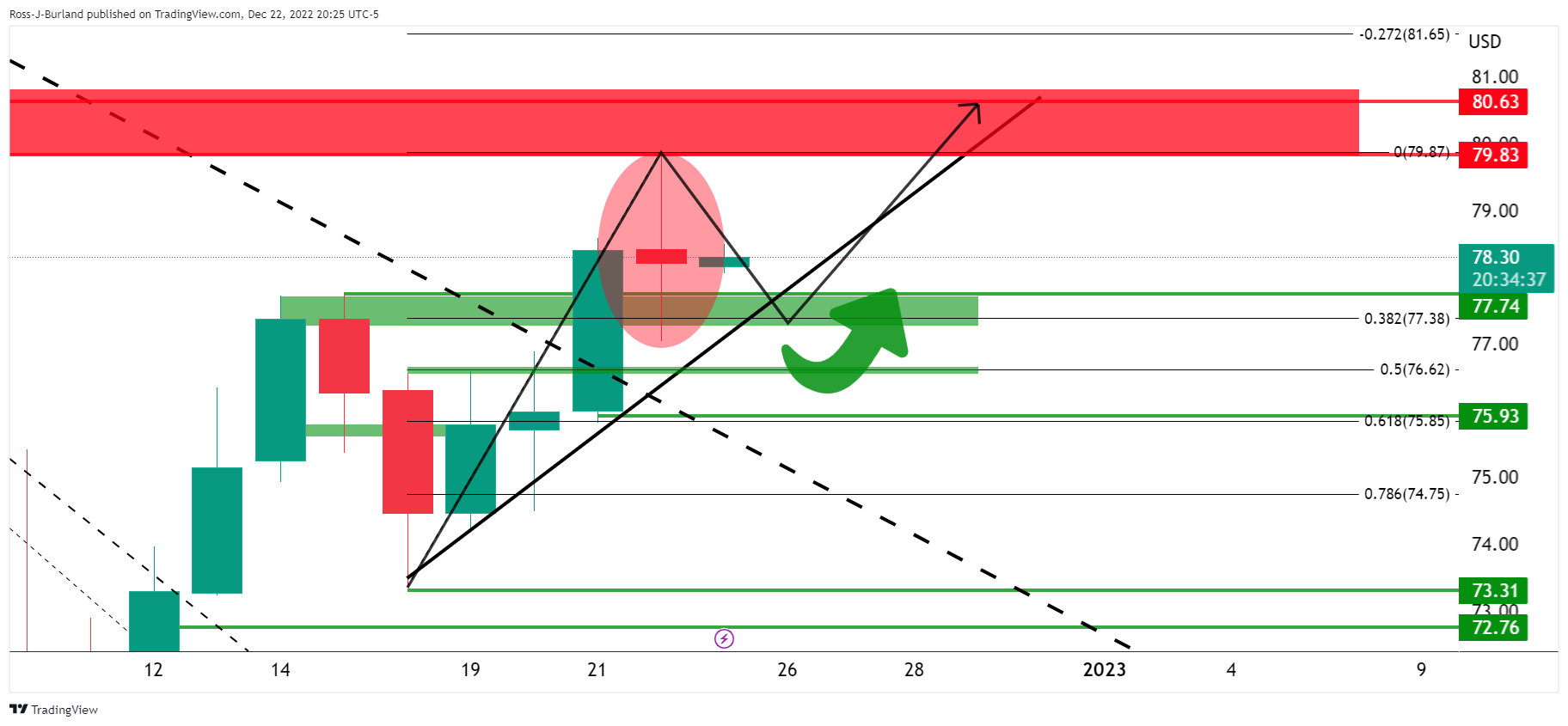

WTI Price Analysis: Bears take on key support

- WTI bears sinking in their teeth to test key support.

- Bears eye the 50% mean reversion area and prior support structure.

West Texas Intermediate (WTI) was pressured lower on Thursday following three straight days of gains and the following technical analysis illustrates an indecisive market on the backside of the bearish trend.

WTI daily charts

The price is on the backside of the prior dominant bear trend but remains on the front side of the micro breakout trend. Therefore, the bias is to the upside e for the time being.

It would be reasonable to expect a correction into the Fibonacci scale and the 38.2% Fibo meets trendline support. If this were to give, however, a deeper move into a 50% mean reversion could be on the cards.